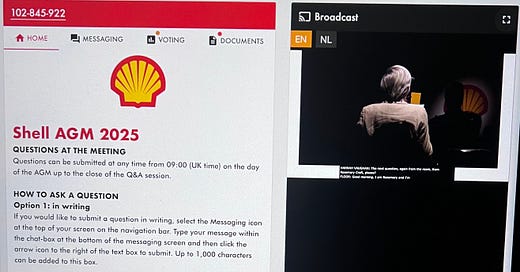

11:40am Tuesday 20 May 2025

Peaceful AGM for a change

Liquified natural gas (LNG), climate and stakeholder vs shareholder engagement are taking centre stage.

Small flags:

1️⃣ Most of the directors are not present - attending virtually instead. This seems to be becoming a trend.

2️⃣ Shell have employed a moderator to field questions, which in other FTSE 100 AGMs, has done by the Co Sec. She has done a great job to be fair. I hope she is a Shell employee.

Running over one hour 40 minutes already: First 1.5 hours was dominated by climate questions.

And we are now getting to shorter questions from older retail, one of whom just commended the company and security for an incident-free AGM! Wehey 🥳🎉 and another being applauded for his passionate plea for the Board to hold their AGMs at 11am! #PensionerPassion

♻️🌎 The first 13 or 14 questions asked were climate- and environment-related, and largely include statements and questions (lasting around 5 minutes each). Several of the questioners are co-signers of requisitioned resolution 22. See p. 7-8 of the notice of AGM https://www.shell.com/investors/shareholder-meetings/_jcr_content/root/main/section/simple/text.multi.stream/1744787927436/24eeccd57647659d9acede0b02f9d333adec5ab7/notice-of-meeting-2025.pdf.

Institutions LAPF Investments and Robeco are included in the first lot of questions. Both are asking for increased engagement. Robeco are supporting resolution 22, although they agree that engagement rather than requisitioning is the better way forward.

According to CEO, two of the co-signers had not engaged with the company prior to requisitioning. According to one of these two, ACCR, the Chair rejected their request to meet - Chair has justified this refusal by stating that his responsibility is to meet with shareholders which ACCR. Statutorily, the Chair is possibly correct, but s.172 of Companies Act implies responsibility to all stakeholders…

I didn’t think my questions about nextgen retail engagment would get asked, but they have just been addressed by both the Chair, who has expressed interest in engaging with retail incl. Gen Z, CFO who provided general information on inclusion via their comms and their capital markets day which I will verify.

I care deeply about our environment, but there are 21 other resolutions, and at big AGMs like these, I really wish that other business could be discussed as robustly as climate, like financial performance, strategy, operations and social impact. These end up not getting addressed or barely having any air time, because of single-topic dominance.

This is a key reason why Gen Z retail investors, who are largely financially motivated, don’t attend AGMs. They sadly view it a waste of time, rather than an opportunity to engage and learn more globally about their investee companies, which we think AGMs should be.

More to follow.